Data Knowledge Catalog

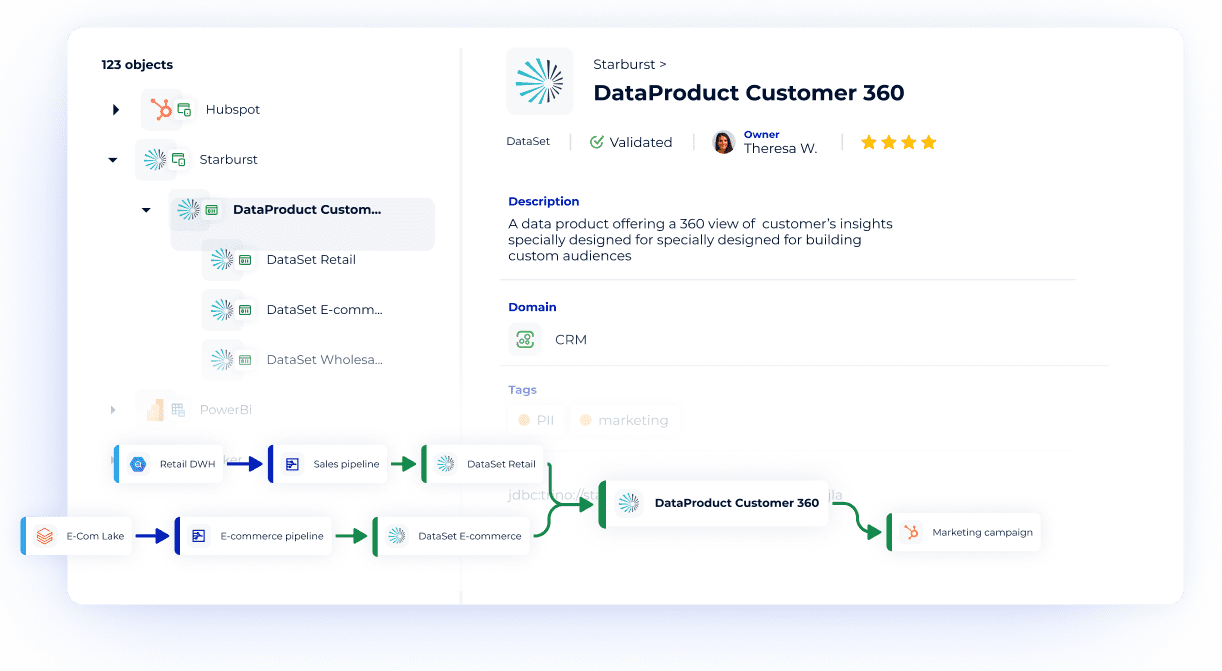

DataGalaxy’s Data Knowledge Catalog offers a unified solution for metadata management, enabling centralization with a Data Dictionary, precise data processing, lineage tracking, and a detailed Business Glossary.

Environmental, social, and governance (ESG) compliance has morphed from a voluntary, self-reporting checklist of corporate responsibility into an increasingly regulated business activity.

As a result, sustainable business models have become a strategic imperative driven by the expectations of investors, consumers, and society.

ESG regulations and standards now originate from multiple federal and global entities. The U.S., France, the EU, and other national entities have introduced an almost competitive array of rules and standards for companies to navigate. Unsurprisingly, companies are turning to robust data governance and management to steer through the increasing complexities of ESG compliance.

Let’s examine how shifting regulatory standards could will influence the ESG compliance strategies of forward-thinking companies.

Substantial new and refreshed ESG regulations reflect a global move toward more stringent and detailed requirements. In the U.S., ESG initiatives vary – For example, consider federal regulations like Nasdaq’s Board Diversity Rule and Sustainability Accounting Standards Board (SASB) standards for sustainability reporting. State-level ESG regulations are diverse, with 20 states enforcing anti-ESG rules, eight adopting pro-ESG laws, and three enacting ESG-related disclosure regulations as of September 2023. This patchwork of rules poses many problems for businesses operating across multiple states.

The European Union’s recent Corporate Sustainability Reporting Directive (CSRD), which will phase in beginning in 2024, marks a significant shift in ESG regulations, expanding the sustainability reporting scope beyond the current Non-Financial Reporting Directive (NFRD). The CSRD requires detailed disclosures on several ESG aspects, including:

The directive aligns corporate strategies with limiting global warming as outlined in the Paris Agreement and the EU’s European Climate Law. It also applies to non-EU entities with significant EU operations, mandating disclosures about their environmental and social impacts.

This directive signifies a shift towards greater transparency and accountability in corporate sustainability efforts, affecting companies both within and beyond the EU. However, several distinct ESG factors are gaining prominence in corporate strategy and compliance.

The focus on key ESG elements such as climate change, diversity, and robust governance mechanisms is intensifying, as these areas are gaining increased priority and prominence in regulatory frameworks and corporate strategies due to stakeholder interest and attention. These elements generating particular interest include:

The enhanced emphasis on these ESG factors signifies a maturing approach to sustainability where comprehensive, actionable, and measurable practices stand paramount. In response, companies are developing strategies to address these focal areas and ingraining them deeply into their operational ethos and corporate identity.

Let’s explore how technology, particularly data catalogs, is becoming integral in enhancing ESG compliance and strategy.

DataGalaxy’s Data Knowledge Catalog offers a unified solution for metadata management, enabling centralization with a Data Dictionary, precise data processing, lineage tracking, and a detailed Business Glossary.

Data catalogs are pivotal tools for managing the surge of ESG-related data, as they keep data clean, secure, and traceable. This is essential for accurate and straightforward regulatory compliance and reporting. The benefits of utilizing data catalogs in ESG compliance include:

Although organizations may experience several challenges when grappling with ESG compliance, there are unique opportunities for growth and innovation for forward-looking organizations.

Challenges in ESG compliance:

Navigating these challenges and capitalizing on the opportunities requires a strategic approach to ESG compliance. In the future, organizations must embrace ESG as a core element of sustainable growth and long-term success. Nevertheless, a decisive strategy is essential for companies to overcome ESG compliance challenges and harness the benefits of sustainable growth.

A path to successful ESG compliance hinges on a blend of strategic planning, sound data management, and adoption of best practices. Here are several key strategies:

Effective ESG compliance requires strategic planning, efficient data management, and adherence to best practices. By establishing clear frameworks, leveraging tools like data catalogs, and integrating ESG values into corporate culture, organizations can navigate compliance complexities and harness opportunities for sustainable growth and innovation.

New regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD) and varied ESG-focused initiatives across U.S. states will begin to take effect. These developments signal a clear shift towards more stringent ESG compliance requirements.

As the ESG terrain becomes more complex, data catalogs emerge as a critical tool for managing ESG data more efficiently and ensuring its accuracy, compliance, and accessibility. Genuine ESG success, however, will belong to organizations that can incorporate ESG values into corporate culture. This integration moves beyond compliance to embrace sustainability as a fundamental business principle.